NEWS

CIP is proud to have had Robby Eaves, CCIM and Phil Morris represent Escuelita del Alma in securing their new location amidst the challenges posed by the I-35 expansion project. This Spanish immersion daycare and preschool, a cornerstone of our community, has faced displacement not once but twice due to urban development. Escuelita del Alma's dedication to providing a nurturing and culturally rich environment for our children is truly inspiring. Despite the upheaval, their commitment to preserving the heritage and language of their students remains steadfast. The I-35 expansion impacts over 100 properties, including many in environmentally sensitive areas. Navigating this complex relocation process has highlighted the resilience of the Escuelita community. Parents, staff, and supporters have rallied together, ensuring that the school continues to thrive. As Austin grows, it's crucial that we balance development with the preservation of our cultural institutions. I look forward to seeing Escuelita del Alma flourish in its new home on Bluestein Drive, continuing to offer invaluable educational experiences to our children. Click here to read more about the challenges face by Escuelita del Alma.

Hance Scarborough, LLP has signed a lease at the Texas Bankers Association headquarters building at 203 W 10th St in downtown Austin. Glen Sorrel of Commercial Industrial Properties represented the tenant in this transaction. Hance Scarborough is a firm that represents and counsels clients in matters involving regulatory and public policy law. They are expected to occupy the space in the fall of 2024. You can read more about the transaction by clicking here.

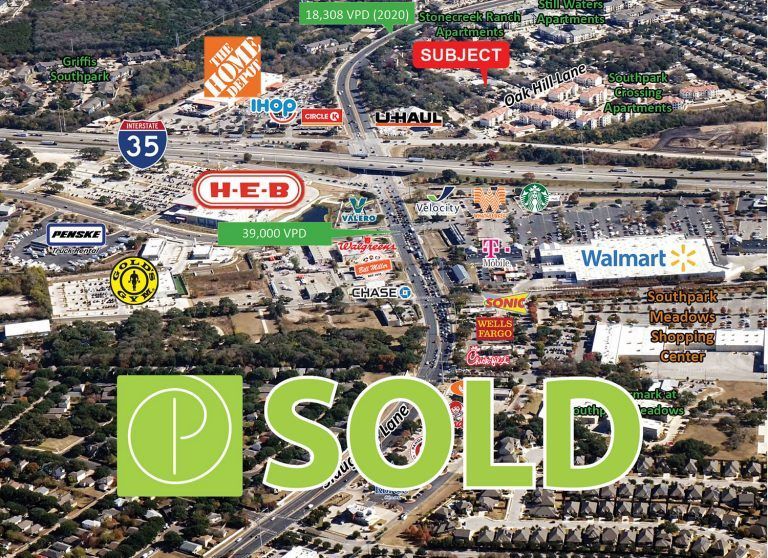

LEASED! MEDICAL OFFICE ON WILLIAM CANNON This past June, Jeff Ecton and Robby Eaves, CCIM joined forces with Austin Spine & Rehabilitation to transform their workspace. The expanding practice had outgrown their old space, and they needed something more suited to their needs without breaking the bank. Challenge accepted! We walked them through the process of relocation vs. staying in the current location and all the factors it would entail. In record time, we found a 2200 square foot space that ticked all the boxes. The new location in Stonegate Two off William Cannon was ideal, not too far from their earlier location in the Medical Village off SW Parkway. It was larger with a better layout and wallet friendly. Plus, the new suite was almost ready to go, slashing their relocation expenses significantly. At CIP, we understand that besides the cost human resources, real estate is usually your largest expense. Looking to upgrade your workspace? Our medical office team is just a call away, ready to help you find your ideal space. Let the team at CIP help you make it happen!

HOW TO IDENTIFY PROFITABLE SECTORS FOR COMMERCIAL REAL ESTATE INVESTMENT IN AUSTIN Commercial real estate investment in Austin has various industries, so finding profitable sectors is critical to maximizing returns. From hospitality tourism to big tech giants like Tesla, Austin has diverse businesses with many factors impacting which commercial properties are ideal for investment. Below is a complete guide to identifying successful commercial real estate in Austin before deploying capital in a new market. HOW TO FIND PROFITABLE SECTORS FOR COMMERCIAL REAL ESTATE INVESTMENT IN AUSTIN To capitalize on the best opportunities for commercial real estate investment in Austin, your investment strategy should include more than following local market trends. In addition to monitoring current market data, investors should conduct a deeper market analysis to determine which sectors have the highest profitability. Through comprehensive industry assessments, investors can find which verticals are thriving so they can invest in the commercial property required to drive the highest returns. Evaluate the following data during your commercial real estate market analysis: Popular Asset Classes: Determine the building type and quality in demand. Local Dominating Industries: Analyze which sectors are contributing most to the local economy. Population and Job Growth: Calculate resident and job growth rates for cash flow projections. Average Income and Buying Power: Ensure local tenants can afford to rent or buy the services/products the commercial property offers. Investors should also consider consulting commercial real estate brokers to minimize financial risks. Brokerage firms not only have expertise in commercial market analysis, but they also have exclusive access to off-market deals and extensive local property data. Here is how to execute an in-depth market analysis to find profitable industries for commercial real estate in Austin and how brokers can help maximize your investment sales. Conduct a Market Analysis to Identify Popular Asset Classes The first step to analyzing potential markets to invest in for Austin commercial real estate is identifying the top-performing asset classes. This data provides insight into which sectors are contributing most to the local economy so you can uncover profitable investment opportunities. The three asset classes of commercial real estate include: Class A: New construction or top-quality buildings built within the last 15 years. Offers investors the opportunity to preserve capital due to minimal property risks and attracting high-income earning tenants. Class B: Fewer luxury amenities and older compared to Class A. Typically easier to find a profitable deal for immediate cash flow. Class C: Buildings over 20 years old with possible maintenance issues. Not highly profitable and requires renovation to increase asset value. Ideal for investors looking to flip commercial properties. For example, there is a current industrial real estate boom in Austin for computer manufacturing, warehouse offices, and data centers. Last year alone, 83 million square feet of industrial leases were recorded in Austin, with projections to keep increasing. From ground leases for Class A manufacturing facilities to renovating Class C buildings for hospitality tourism in metropolitan areas, understanding the asset value of commercial real estate is crucial. Identifying assets that are generating the highest revenue is key to investing in the most profitable commercial real estate markets. Research Population and Job Growth Data to Determine Profitability Population and job growth data provide insights into strong sectors for commercial real estate investment in Austin through a data-driven approach. The capital city of Texas currently has a thriving high-tech economy that is driving a younger workforce due to its increasing career opportunities. Big tech companies, like Dell, employ more than 13,000 local Austin residents, and Tesla has around 12,000 regional staff. Electronics R&D and manufacturing also represent 65% of manufacturing employment within the Austin region. In addition to job and population growth, analyze Austin’s unemployment rate compared to the national rate. This information determines if commercial tenants can afford rent or generate cash flow sustainably. If the unemployment rate is high or rising, job creation decreases, and the risk of office vacancies increases. Employment opportunities profoundly impact which business sectors and areas of commercial real estate are the most profitable. According to the Austin Chamber of Commerce , the fastest job sector growth in the last year was hospitality at 11.7%. Wholesale trade industries fell closely behind at 6.5%. They also stated that Austin is the 7th best-performing metro out of the top 50 regarding job growth in the last 12 months. If the population and jobs are growing within a specific industry and area, these are signs of successful sectors to invest in locally. Analyzing this data ensures that the local supply and demand are there and provides insights into the current market performance. Analyze Local Market Landscapes to Discover Dominating Industries As mentioned above, Austin has a significant influx of new residents who are young working professionals (specifically millennials) in computer manufacturing technology. The Austin Journal states that Austin ranked #1 in the U.S. for millennial population growth in 2021 and continues to attract more similar resident demographics. Due to the city’s booming tech and manufacturing industries increasing local job creation, Austin has become a “millennial magnet.” Since millennials are currently at the height of their working age, they are seeking career opportunities in a successful local economy, and many are becoming first-time homebuyers. Consider Austin commercial properties with close access to the Capital Metro line, street parking, and downtown Austin to accommodate employees traveling to work. By discovering dominating industries influencing job and population growth, you can better determine local commercial real estate worth investing in. — ACCORDING TO THE AUSTIN JOURNAL, AUSTIN RANKED #1 IN THE U.S. FOR MILLENNIAL POPULATION GROWTH IN 2021 AND CONTINUES TO ATTRACT SIMILAR RESIDENT DEMOGRAPHICS. — Additionally, look for hyper-local and cultural trends in submarkets this population brings to capitalize on new demands and cash flow opportunities. For example, Austin is known as the “Live Music Capital of the World” due to its vibrant art culture. Dining restaurants and music venues can be profitable sectors for commercial real estate investment in Austin due to its growing young population contributing to these submarkets. Learn the Local Average Income and Buying Power Before Deploying Capital There are also socio-economic factors impacting whether it is worth deploying capital in a commercial market. When conducting a local market analysis, look at resident and business median salaries to determine if the real estate you want to invest in is affordable for that area. These insights will provide the local average income and buying power to calculate if it has potential profitability and affordability for nearby businesses and tenants. To determine the profitability of commercial real estate investment in Austin, ensure that local tenants can afford rent or become a target customer. If the data shows that the local economy cannot afford to rent or buy what the business is selling, it is not advisable to purchase that property. Before you invest in commercial real estate, ensure there is capital market access with local supply and demand for the type of property you are interested in. Validate Potential Profitability for Commercial Real Estate with Local Competitors Did you know that Austin investors were awarded nearly 4,400 patents last year? According to the Austin Chamber, the city ranks 11th for total patents awarded out of the 366 U.S. metros. If your competitors are investing in specific commercial property niches within the area, this is a sign of sector profitability. In contrast, if there are commercial properties with similar demographics to the ones you are considering and have high vacancy rates, this is an indicator of poor market performance. Analyzing your competition is an effective way to validate if a commercial real estate sector lacks profitability potential. Work with a Commercial Real Estate Broker to Access Off-Market Deals One of the most effective strategies for finding commercial real estate industries worth investing in is working with brokers for off-market deals. Local brokerage firms can help you navigate unlisted commercial properties with the most profitable potential through their exclusive data and network. It not only gives you a competitive advantage, but it also discovers return opportunities based on capital improvements and restricted market data. Some multiple listing service (MLS) platforms restrict access to agent use only. For this reason, you may miss a potential investment opportunity if there is an industry demand for a particular commercial property that is unlisted. Brokers have access to unlisted property performance data for off-market deals. Additionally, brokers have exclusive relationships within their professional network. These privileges provide commercial real estate investors with opportunities to cash in Austin’s growing economy and diverse markets. Benefits of utilizing brokers for off-market deals in Austin commercial real estate include: Early access to off-market listings No paid subscription is required for a multiple listing service (MLS) Streamlined access to professional MLS— instead of lengthier processes through the local county’s public tax office or tax records Privilege of exclusive broker relationships for unlisted property access Strong selling experience with off-market property owners Simpler sales process due to no required negotiations and no red tape involved Potential for reduced pricing for convenience or from strong broker relationships Texas commercial real estate brokers can optimize your off-market searches based on target sectors, investment budgets, and exclusive deals, which you can often not easily access on your own. Through their local real estate assessments, they can help you better project future cash flow based on property data and expertise in off-market industry trends. DISCOVER PROFITABLE SECTORS FOR COMMERCIAL REAL ESTATE INVESTMENT IN AUSTIN Identifying the best commercial real estate markets to invest in is a comprehensive and analytical process. The capital city of Austin offers various sectors that can diversify investment portfolios and revenue streams. However, finding submarkets that are driving the highest returns is the foundation of profitability. At CIP Texas, our local Austin brokers can help you identify potential real estate opportunities based on in-depth market assessments and past property performance. Through data-driven strategies and in-depth industry analysis, we can help you refine future cash flow projections before deploying capital. Do you want to maximize your investment sales for commercial real estate in Austin? Contact us to capitalize on the opportunities of Austin’s growing economy today.

CIP WELCOMES BRIAN E. SMITH CIP would like to introduce our newest team member, Brian E. Smith . Brian is a forward-thinking real estate advisor, investor, entrepreneur, and community leader. As an Associate at Commercial Industrial Properties, he serves as a trusted source for acquisitions and dispositions, leasing, land development, and the entitlement and construction of light industrial projects. Brian brings over 18 years of experience in finance, business, and commercial real estate, where he specializes in brokerage and development. Given his former background in building and managing an industry-recognized wealth management firm, Brian has become an expert in business operations, leadership, capital raising, and mergers and acquisitions. Brian’s knowledge of leasing operations and industrial development gives him a competitive edge when working with clients across the commercial real estate space. We hope you’ll join us in giving Brian a warm welcome! Brian E. Smith Associate brian@cipaustin.com 512-682-1014 office 512-731-4132 cell

LEASED! OFFICE SPACE IN NORTHWEST AUSTIN Commercial Industrial Properties is pleased to announce that Datacom Design Group has just moved into their new office at 9111 Jollyville Road in Austin. They were represented by Evan Bole of CIP, who helped them relocate to the 2,909 SF space. Datacom Design Group provides highly specialized technology consulting and professional design services to Owners, Architects, and Project Developers.