May 15, 2025

Quick Summary Before You Read.....

Question: How are Texas' advancements in nuclear energy and the growth of data centers impacting commercial real estate (CRE)?

Answer: Texas' push into advanced nuclear energy and the rapid expansion of data centers are transforming the state's energy infrastructure, leading to significant implications for commercial real estate. These developments are driving increased demand for industrial properties near energy and tech hubs, creating opportunities for investors and developers in the CRE sector.

For a detailed exploration of these trends, you can read the full article here: Texas' Energy Infrastructure and CRE Implications

Texas' Energy Infrastructure and CRE Implications

Texas is entering a new era of energy evolution—one defined not just by oil and gas, but by advanced nuclear technology and the explosive growth of data centers. These two powerful forces are reshaping the state's infrastructure and creating ripple effects across the commercial real estate (CRE) sector. For investors, developers, and asset managers, understanding this transformation is critical to identifying emerging opportunities and mitigating potential risks.

Texas' Nuclear Vision: From Fossil to Fission

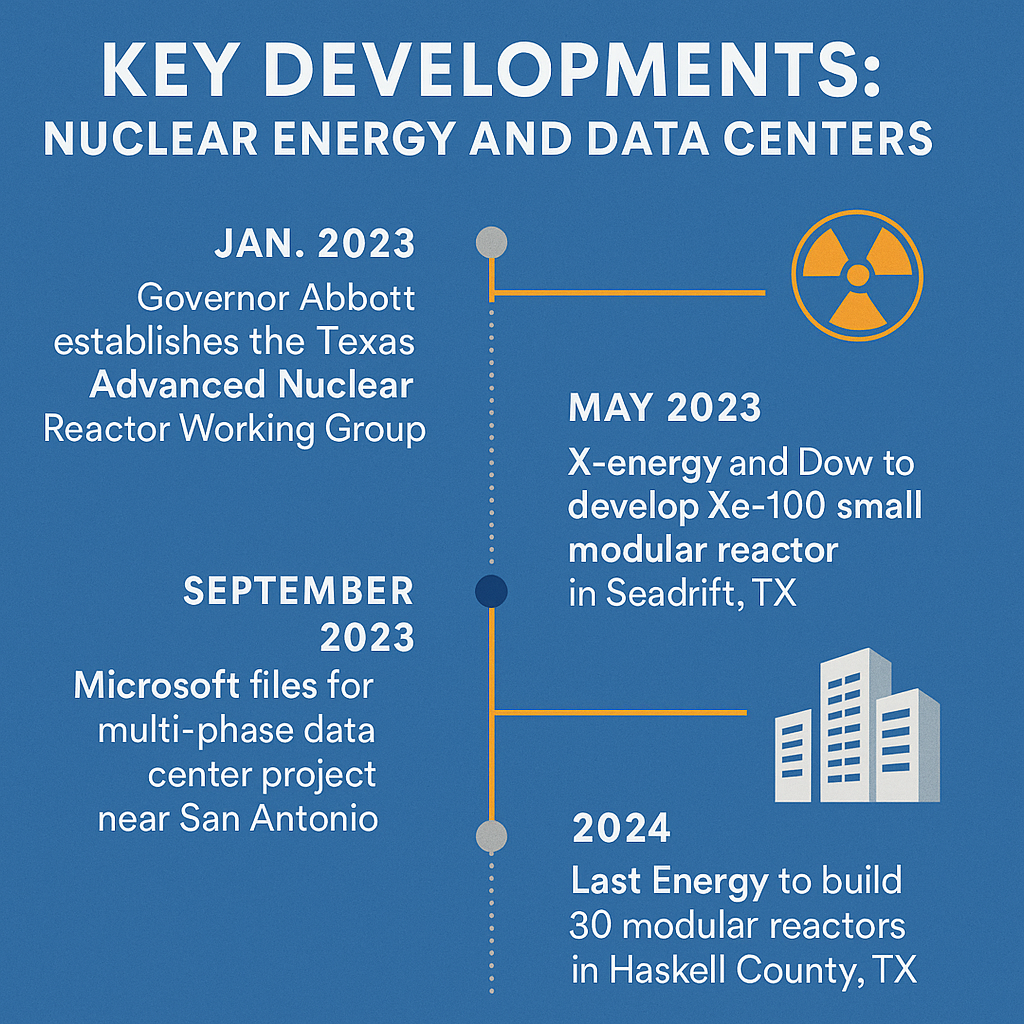

In recent years, Texas has taken bold steps toward diversifying its energy portfolio with the aim of becoming a national leader in advanced nuclear energy. In 2023, Governor Greg Abbott launched the Texas Advanced Nuclear Reactor Working Group, signaling the state’s commitment to exploring cutting-edge solutions to meet its future energy needs. This effort culminated in a legislative proposal for the Texas Advanced Nuclear Energy Authority and the establishment of a $2 billion Nuclear Energy Fund.

Several prominent players have already stepped up:

- X-energy, a Maryland-based firm, is partnering with Dow to develop a Xe-100 small modular reactor (SMR) in Seadrift, Texas, supplying low-carbon electricity and steam to an industrial facility.

- TerraPower, backed by Bill Gates, is exploring co-location of SMRs with data centers, targeting synergy between high energy demand and reliable supply.

- Last Energy, a microreactor developer, has announced plans to deploy 30 modular reactors in Haskell County, Texas.

These nuclear developments aren’t just energy projects—they are regional economic catalysts that will require

infrastructure, workforce housing, service industries, and long-term support. Each element represents untapped potential for commercial real estate development.

Data Centers Surge: Tech's Demand on Texas' Grid

As the AI revolution accelerates and cloud computing becomes central to global commerce, Texas is emerging as a data center powerhouse. The state’s low energy costs, abundant land, and business-friendly regulations make it an attractive location for tech giants like Microsoft, Amazon, Meta, and emerging players like Rowan Digital Infrastructure.

Highlights include:

- Microsoft recently filed to build

a multi-phase data center campus outside San Antonio.

- Rowan is constructing advanced facilities in Medina County, part of the scenic Texas Hill Country.

- ERCOT (Electric Reliability Council of Texas) estimates electricity demand could double by 2030, with much of the increase driven by large-scale users like data centers.

These tech facilities require vast square footage, reliable power, sophisticated cooling systems—and they often become anchors for new industrial corridors. But they also bring challenges, especially when it comes to resource usage. Data centers consume large quantities of both electricity and water, putting pressure on municipalities and water districts, particularly in drought-sensitive regions.

CRE Investor Implications: Where Energy Meets Opportunity

These rapid developments in both energy production and data consumption are reshaping Texas’ CRE market. Here's how:

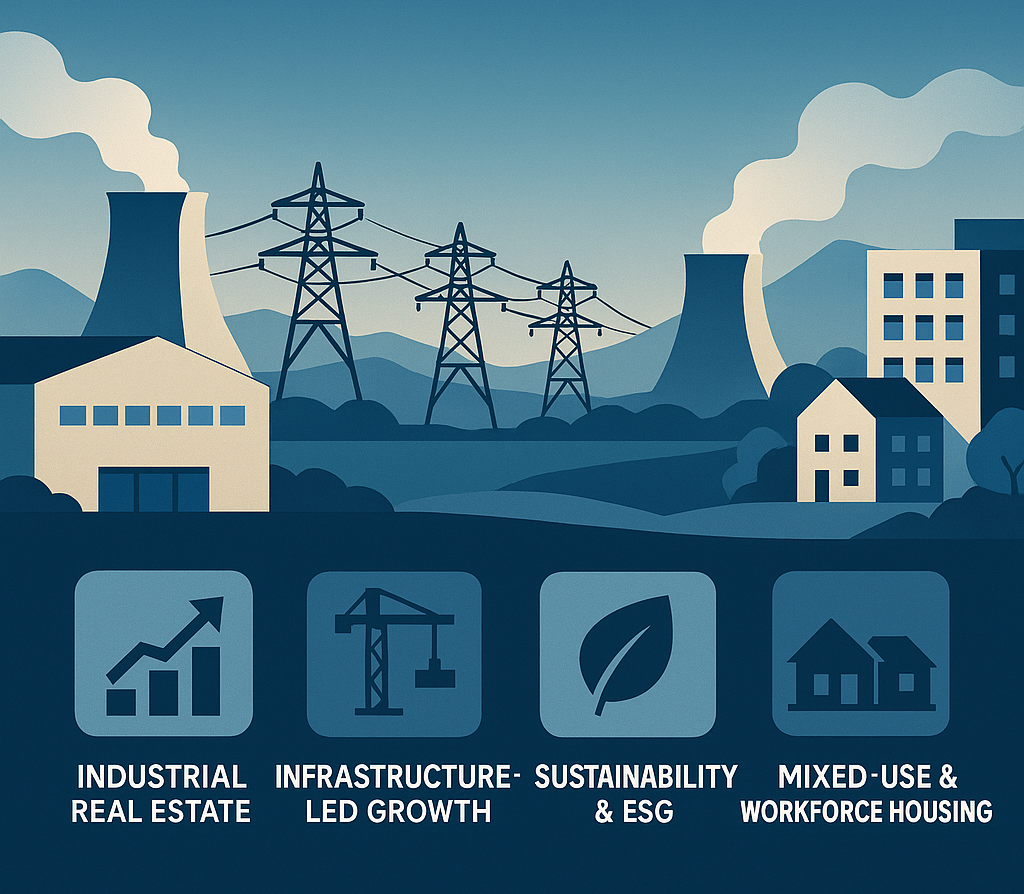

1. Industrial Real Estate Booms

With growing demand for grid-adjacent land, cooling infrastructure, and support facilities, industrial property near planned nuclear and data center sites is poised for appreciation. Locations with existing utility easements and access to transmission lines will command a premium.

2. Infrastructure-Led Growth Corridors

Just like highway construction has

historically driven suburban sprawl, energy infrastructure will now drive regional CRE growth. Investors should watch areas with new transmission projects, substation expansions, or utility-scale developments.

3. Sustainability & ESG Pressure

Modern investors are increasingly focused on Environmental, Social, and Governance (ESG) factors. While nuclear offers carbon-free energy, concerns about water usage, environmental impact, and long-term sustainability remain. CRE stakeholders who integrate eco-conscious design and resource-efficient operations will have a long-term edge.

4. Mixed-Use and Workforce Housing Opportunities

New developments—especially those in more rural or exurban areas—often require housing, amenities, retail, and schools to support an influx of skilled labor. CRE developers should anticipate these needs and offer solutions ahead of demand

Looking Ahead: Strategic Positioning in a Dynamic Landscape

Texas is no stranger to large-scale energy shifts—but the current blend of digital infrastructure needs and advanced nuclear investment presents a unique opportunity for commercial real estate players.

Whether you're an investor seeking land near future SMR sites, a developer eyeing industrial opportunities near AI “factories,” or a property manager navigating ESG compliance—the CRE landscape is changing rapidly. Strategic partners like CIP Texas can help you stay ahead.

Want to capitalize on Texas' energy evolution?

Partner with CIP Texas for location intelligence, market analysis, and investment guidance.