December 18, 2025

When Should You Sell Your Commercial Property in Texas?

If you own commercial or industrial property in Texas, you’ve probably asked a version of the same question:

“Should I hold this a little longer… or is it time to sell?”

There’s no one-size-fits-all answer. The “right” timing depends on the market, your property’s performance, and your own goals as an owner or investor.

This guide walks through practical, Texas-specific signals that it may be time to sell—and how a firm like CIP Texas helps owners make that call with real data instead of gut feel.

1. Start With the Market: What Is Texas Doing Right Now?

Before you zoom in on your individual asset, zoom out.

Texas is still growing: statewide forecasts for 2025 call for continued population and income growth, with Texas expected to outpace the U.S. in personal income and population gains. That long-term growth story is one reason investors continue to target Austin and other major metros.

But not every sector moves the same way:

- Industrial remains a standout in markets like DFW and Austin, with strong demand and limited new supply in many submarkets.

- Retail has quietly tightened, with historically low vacancies and selective new construction.

- Office is more mixed, with a “flight to quality” and older or poorly located buildings facing more leasing risk

What this means for you:

If you own property in a hot sector or submarket (e.g., well-located industrial, strong grocery-anchored retail), the current environment may be a good window to test pricing while demand is deep. If you own a challenged office asset or a property losing relevance, selling before more vacancy hits the market can preserve value.

2. Property-Level Signals It Might Be Time to Sell

Even in a strong market, your individual property can tell you when it’s time to consider a disposition.

A. Your NOI Has Plateaued (or Is Drifting Down)

If:

- Rents are at or near market,

- Operating expenses (including property taxes, insurance, and repairs) are climbing, and

- You don’t see a clear path to meaningful NOI growth,

you may be approaching the “mature” phase of the hold. At that point, you’re mostly clipping coupons—valuable, but often a sign it’s time to weigh selling and rolling into a higher-growth asset.

Texas’ relatively high property taxes—which help fund local services in a state without an income tax—can also compress NOI when valuations jump. In many triple-net structures you can pass taxes through to tenants, but there’s a limit to how much tenants will tolerate before it affects renewals.

B. Your Leases Are in a “Sweet Spot” for Buyers

From a buyer’s perspective, the best time to buy is often when your leases look the cleanest:

- Strong tenants with good credit or performance

- High occupancy (90–100%)

- Healthy remaining term, often 3–7+ years of weighted average lease term (WALT)

- Reasonable, predictable rent increases

Portfolio sales data shows that properties with long-term leases and a stable tenant base tend to sell faster and for better pricing.

If your building is almost full, with recently renewed tenants and minimal short-term rollover, you may be at peak buyer appeal—even if you personally feel like you “just finished” all the hard work.

C. Major Capital Expenditures Are Coming

Another common selling trigger: looming capital projects, such as:

- Roof replacement

- Parking lot reconstruction

- Code-driven upgrades (fire/life safety, accessibility)

- Major mechanical (HVAC, elevators, chillers)

If your reserves are thin or you’d prefer not to write a large check, selling before those projects hit can make sense—especially if the buyer pool includes users or value-add investors who plan to reconfigure or redevelop anyway.

D. The Property No Longer Fits Your Strategy

Sometimes the property’s fine—but you’ve changed:

- You’re over-weighted in one submarket or asset type.

- The property is management-heavy and you want something more passive.

- You’re moving from small single-tenant deals to larger multi-tenant or industrial assets.

In those cases, selling isn’t about performance problems; it’s about trading into assets that better fit your current risk profile and time commitment.

3. Personal and Tax Considerations for Texas Owners

Real estate is an investment and a tax strategy. Timing your sale around your own financial picture can be just as important as timing the market.

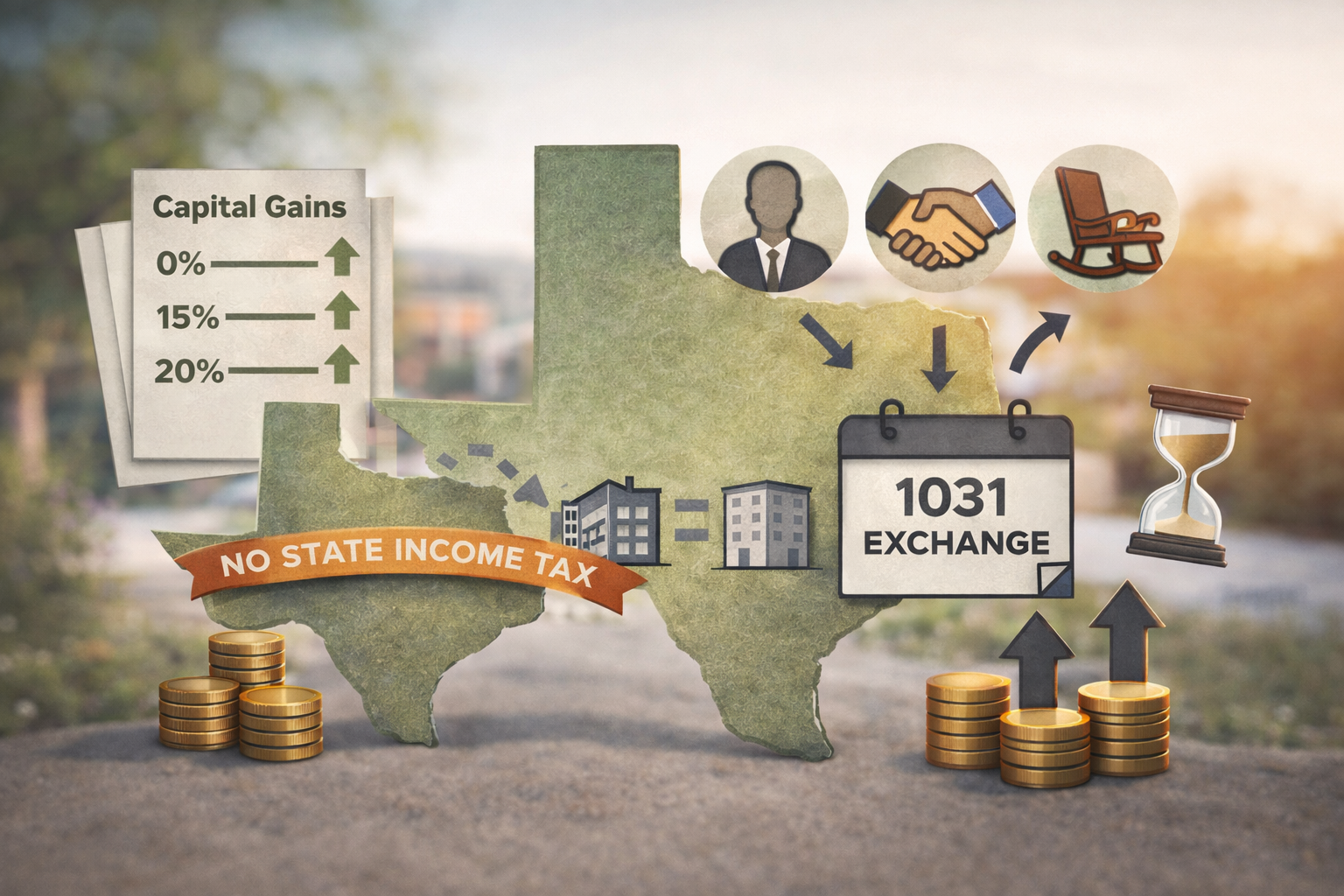

A. Capital Gains and Holding Period

If you’ve held your property for more than a year, your profit is typically treated as long-term capital gains, taxed at federal rates of 0%, 15%, or 20% depending on your income level.

Because Texas has no state income tax, there’s no additional state income tax on those gains, which can make selling Texas assets relatively attractive compared with high-tax states.

On the other hand, large gains can bump you into higher brackets or trigger the 3.8% Net Investment Income Tax if your income is high enough.

B. 1031 Exchange Timing

If you’re looking to defer capital gains, you may time your sale around a planned 1031 exchange, using the proceeds to buy another “like-kind” property. Done correctly, this lets you roll equity forward without paying tax today.

That means your “sell vs. hold” decision isn’t just about price; it’s also about whether you have a next deal lined up in Texas (or elsewhere) that you’d rather own for the next 5–10 years.

C. Life Events and Liquidity

For many Texas owners, the right time to sell lines up with personal milestones:

- Retirement or stepping back from day-to-day management

- Buying out a partner or resolving estate issues

- Funding a new venture or diversification into other assets

If you know one of these events is 12–24 months away, it’s smart to start talking with your broker now so you can prep the property, address easy value-add items, and bring it to market at the right time rather than selling under pressure.

4. Texas-Specific Market Clues It May Be Time to Sell

Here are a few regional clues that it might be a good window to evaluate your asset:

- Your submarket is on investors’ “short list.”

Austin, DFW, and other high-growth corridors continue to attract capital because of strong population and job growth, infrastructure investment, and deep tenant demand. - Interest rates are stabilizing or easing.

Forecasts for late 2025 show policy rates moderating from prior peaks and long-term borrowing costs in a more “normal” range. When financing is more predictable, more buyers come off the sidelines. - Vacancy in your sector is tightening.

Tight retail and industrial availability in many Texas markets gives sellers more leverage on pricing and terms. - You’re ahead of the curve on functional obsolescence.

If you own an older asset that still “works” today but may struggle to meet future expectations (power and clear heights for industrial, parking/loading for retail, amenities for office), selling before obsolescence becomes obvious can preserve value.

5. A Simple Owner Checklist: Is It Time to Talk About Selling?

You don’t have to decide today—but if you can answer “yes” to several of these, it’s probably time to at least get a valuation conversation started:

- My property is 90%+ leased with stable tenants and solid remaining term.

- Rents are at or near market, and I don’t see major upside without big capital spend.

- I see large capex on the horizon (roof, parking lot, systems, code upgrades).

- I’m over-concentrated in this asset type or submarket.

- I’d seriously consider selling if I could get today’s pricing.

- I have an opportunity to trade up via a 1031 exchange or reinvest into a better-fit asset.

- A major life or business event is coming in the next 1–2 years and I’ll need liquidity or less management.

If that sounds like your situation, you don’t have to put up a “For Sale” sign tomorrow. But you should have updated market data and a realistic pricing range so you can decide from a position of strength.

6. How CIP Texas Helps Owners Decide When to Sell

CIP Texas is a full-service commercial real estate firm based in Austin, serving investors and owners statewide with Investment Sales and Asset Management, along with leasing, land advisory, and consulting.

When owners come to us asking, “Is now the time to sell?” we help by:

- Analyzing current value and buyer demand for your specific asset type and location

- Reviewing lease terms, rollover, and NOI trends to see how the property will look to buyers

- Identifying low-cost enhancements that could improve pricing or marketability

- Mapping possible hold vs. sell scenarios, including 1031 timing and reinvestment options

- Designing a disposition strategy if you decide to move forward—target buyer profiles, marketing channels, and realistic timelines

Thinking About Selling a Commercial Property in Texas?

Whether you own a single industrial building, a multi-tenant retail center, or a small portfolio across the I-35 corridor, timing your sale correctly can unlock years of value in one transaction.

If you’d like a confidential, no-pressure conversation about when to sell your commercial property in Texas:

- Call CIP Texas at 512-682-1000, or

- Reach out through our website here.

We’ll help you understand what your property is worth today, what it could be worth tomorrow, and how to align your sale timing with your investment strategy.